Plan Your Future with Expert Guidance: Innovating Business Growth With Ai

In today's complex business landscape, our expert advisors are here to help you navigate the uncertainties and design a customized plan that aligns with your unique goals and aspirations by utilizing Ai to help you realize your true funding potential and unlock new levels of growth.

What we do

Providing Small Business Growth with Seamless CashFlow

We specialize in providing Financing for small business owners partnering exclusively with Independent Sales Organizations (ISOs) to deliver essential working capital to their clients. Your success is our top priority, and we are committed to providing seamless financing solutions tailored to your clients’ needs. When you choose to work with us, you can trust that getting your clients financing efficiently is our primary focus.

Diverse Options

Flexible Options

Fast Approvals

Dedicated Support

Around-the-Clock Simplified Approval Process

Our quick and easy application process ensures that clients can secure financing in no time, allowing them to focus on what matters most—their business growth. Experience hassle-free and fast lender matching that streamlines your access to financial support, allowing you to focus on your operations and business growth goals.

Hassle Free & Fast Matching With Trusted Asset-Based Lenders

An asset based Finance or asset utilization uses assets as income. Whether you are a retiree with a small fixed income or a self-employed borrower, the ease and benefits of asset-based loans and mortgages have made them a popular solution for borrowers in recent years. This type of financing is especially popular among those looking for an alternative to a no doc loan. With an asset-based Finance agreement, also known as an asset depletion, borrowers are granted Finance based on their assets.

Responsible Funding

Our sustainable lending practices are designed to help small businesses get ahead. Traditional lenders reject most applications for small business loans, but at Nexus Lenders, approvals are based on your business’s potential—not your credit rating—so we’re able to fuel the growth of more small and mid-sized businesses. We won’t over-leverage your business, and unlike some lenders, we don’t restrict how you use your funds.

FAQS

What is the benefit of working with a financial advisor?

Working with a financial advisor offers numerous benefits. First and foremost, advisors provide expertise and guidance tailored to your unique financial situation and goals. They can help you create a comprehensive financial plan, optimize your investments, minimize taxes, and ensure you're on track to achieve your financial objectives. Additionally, advisors offer peace of mind, knowing that you have a professional managing your financial affairs and helping you make informed decisions.

How do I choose the right financial advisor for my needs?

Choosing the right financial advisor is a critical decision. Start by assessing your own financial goals and preferences. Look for advisors with the appropriate qualifications and certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). Consider their experience, specialization, and track record. It's also important to have a consultation or interview to ensure their approach aligns with your values and objectives. Lastly, check for transparency in fees and compensation to avoid surprises.

Do I need a large portfolio to benefit from financial advisor services?

No, you don't need a large portfolio to benefit from financial advisor services. Financial advisors can assist individuals at various stages of their financial journey, from those just starting to save to those with substantial assets. Advisors can help you create a financial plan, manage debt, set up an emergency fund, and make the most of your resources, regardless of your current wealth. Their goal is to help you improve your financial well-being and work towards your financial goals, whatever they may be.

What Are Our Customers Saying ?

Feedback from our delighted clientele.

I can't thank Nexus enough for their unwavering support and expert guidance. When my husband and I faced a sudden crisis with our roofing business, we didn't know where to turn. They were there for us, day and night, helping us make sound decisions.

Michie Warton, IL

I've been a client of Nexus Lenders for years, and I can confidently say they've transformed my financial outlook. Their services have allowed me to seize investment opportunities at the right moment and navigate market turbulence with ease.

J. Trupport, NY

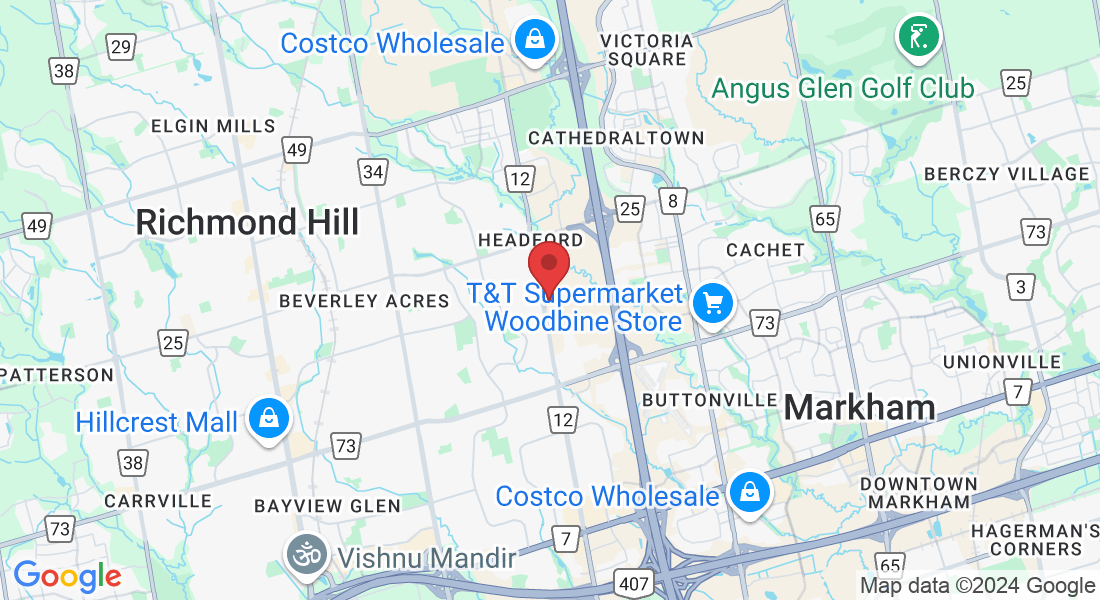

Get In Touch